The Kentucky Employees Health Plan (KEHP) has a fiduciary and legal responsibility to ensure that our health plans are only covering legally eligible dependents. As a result, the KEHP health plan and the Kentucky Department of Employee Insurance have partnered with Alight Solutions, Inc. to conduct ongoing dependent eligibility verification and re-verification processes for spouses and step-children.

Alight will contact retirees by sending a letter directly to them requesting documents be sent directly to Alight. KPPA cannot submit these documents for you.

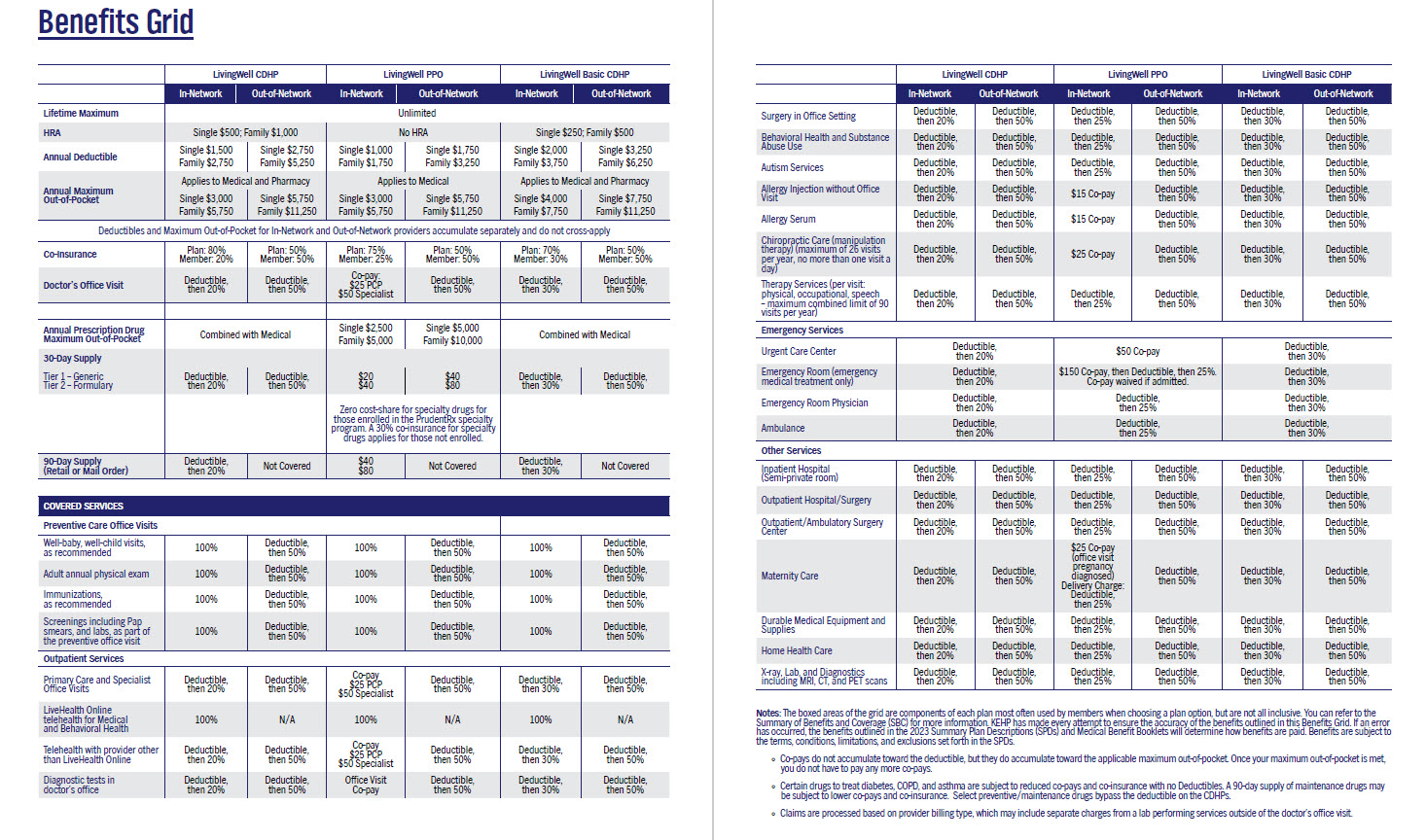

Click on the Benefits Grid below to see plan options. Hazardous Duty Retiree: Yearly Requirement

Hazardous Duty Retiree: Yearly Requirement

In order to determine your cost for coverage in 2023, please refer to the guides below.

*KPPA does not pay a contribution for coverage on behalf of a beneficiary receiving a monthly retirement benefit. Beneficiaries obtaining coverage should enter "$0.00" for the percentage contribution. Exception: If you are a spouse beneficiary or a dependent child receiving a monthly benefit under the Fred Capps Memorial Act, contact KPPA.

Click here to read more about eligibility for children and spouses to receive coverage and premium contributions.

2023 Amount KPPA Pays for Dependent Coverage - Hazardous Duty Only** / Percentage Contribution

| Months of Hazardous Service | Amount KPPA Pays Toward Parent Plus | Amount KPPA Pays Toward Couple Plan | Amount KPPA Pays Toward Family Plan | Amount KPPA Pays Toward Family X-Ref*** |

| 240+ months | $343.66 | $958.78 | $1,154.98 | $1,162.40 |

| 180-239 months | $237.75 | $719.09 | $866.24 | $871.80 |

| 120-179 months | $171.83 | $479.39 | $577.49 | $581.20 |

| 48-119 months | $85.92 | $239.70 | $288.75 | $290.60 |

| 0-47 months | $0.00 | $0.00 | $0.00 | $0.00 |

**The amounts paid in the table above are in addition to the amounts in Hazardous Duty Retiree Percentage Contribution table, based on overall service and hazardous service earned by retiree. Contact spouse's Insurance Coordinator for information on spouse's portion of premium.

***If you have at least 48 months of hazardous service, the cross-reference option is selected, and the retiree has a surplus of contributions to cover the retiree's portion of the premium, the surplus will be applied to the spouse's portion of the premium.

****Add the value for the Tobacco Usage to the overall cost of your premium.

TOBACCO USER NOTICE****

The Commonwealth of Kentucky is committed to fostering and promoting wellness and health in the workforce. You are eligible for the non-tobacco user premium contribution rates provided you certify that you and any other person to be covered under your plan has not regularly used tobacco within the past six months.

Regularly means tobacco has been used four or more times per week on average excluding religious or ceremonial use.

Tobacco means all tobacco products including, but not limited to, cigarettes, pipes, chewing tobacco, snuff, dip, and any other tobacco products regardless of the frequency or method of use.

Dependent means, for the purpose of the Tobacco Use Declaration, only those dependents who are 18 years of age or older. If you have regularly used tobacco within the past six months, you are subject to the monthly fee . For those with single coverage, the fee is $40.00 per month. For those with any dependent coverage (Parent Plus, Couple, Family), even if only one person uses tobacco, the fee is $80.00.

Dollar Contribution Rates Plan Year 2024

Effective January 1, 2024, individuals with the Dollar Contribution benefit for health insurance (retirees hired on or after July 1, 2003), are allowed to seek reimbursement from KPPA for health insurance coverage outside of KPPA insurance plans.

Example: You would be required to submit the

Form 6280 - Application for Dollar Contribution Reimbursement for Medical Insurance and either Form 6281 - Employer Certification of Health Insurancefor Dollar Contribution Reimbursement Plan or

Form 6242 - Insurance Agent/Company Certification of Health Insurance for Health Insurance Reimbursement Plan. These forms, in addition to any required documentation, should be submitted in April 2024 for the months of January 1, 2024 - March 31, 2024. Review the Form 6280 instructions carefully to determine what forms and documentation are required for your situation.

Is your Participation Date After July 1, 2003?

See the Dollar Contribution Rates Below.

If you began participating on or after July 1, 2003, please read the information below. If you have additional questions call KPPA at 1-800-928-4646 (Toll Free) or 502-696-8800(Frankfort).

Use this guide if you are receiving benefits, were hired July 1, 2003 or later, and began participating with KPPA between August 1, 2004 and August 31, 2008.* Or began participating with KPPA on or after September 1, 2008.**

*In order to be eligible for health insurance benefits, you must have 120 months of service upon retirement.

**In order to be eligible for health insurance benefits, you must have 180 months of service upon retirement.

For service in a nonhazardous position, you will receive a monthly dollar contribution of $14.41 for each year of service per month. The Dollar Contribution will increase by 1.5% on July 1.

i.e. if you began participating September 1, 2003 in a nonhazardous position, and retired effective October 1, 2013, you would receive $144.10 per month towards health insurance premiums.

For service in a hazardous position, you will receive a monthly contribution of $21.62 for each year of service per month. The Dollar Contribution will increase by 1.5% on July 1.

i.e. if you began participating September 1, 2003 in a hazardous position, and retired effective October 1, 2013 you would receive $216.20 per month towards health insurance premiums.

If you have hazardous and nonhazardous service, you will receive contribution based on the amount of full years of service for each.

i.e. if you began participating September 1, 2003 in a nonhazardous position until September 30, 2008 (5 years x $14.41 = $72.05), and then began participating October 1, 2008 in a hazardous position, and retired effective November 1, 2013 (5 years x $21.62= $108.10), you will receive $180.15 per month towards health insurance premiums ($72.05 + $108.10 = $180.15).

If you have a partial year of hazardous service and a partial year of nonhazardous service, they can be combined to equal a full year, you will receive 1 year of non-hazardous service.

i.e. if you have 9 years and 6 months of nonhazardous service and 6 months of hazardous service, your insurance contribution will be based on 10 years of nonhazardous service. You will receive $144.10 per month towards health insurance premiums.

If you are receiving a monthly retirement benefit, that qualifies you to receive a Health Insurance Percentage contribution and also receiving a monthly retirement benefit that qualifies you to receive a Health Insurance Dollar contribution, please contact the Retirement office for help calculating your cost.

Calculating Your Insurance Cost if Your Participation Date is After 7/1/2003

Hazardous Formula:

Service Credit-Dollar Contribution Level Amount ($21.62*) x Years of Service = Amount KPPA Pays

Hazardous Example:

$21.62* x 10 (let's say you have 10 years of service for this example) = $216.20

Nonhazardous Formula:

Service Credit-Dollar Contribution Level Amount ($14.41**) x Years of Service = Amount KPPA Pays

Nonhazardous Example:

$14.41** x 10 (let's say you have 10 years of service for this example) = $144.10

Additional Resources

KEHP Prescription Drug Coverage

KEHP Value Benefits for Diabetes, COPD, and Asthma

KEHP Diabetes Benefits

KEHP Vendor Partners

Diabetes Prevention

LiveHealth Online

Rethink Benefits

SmartShopper

Open Enrollment Hotline

1-888-581-8834 or 502-564-6534

Service is only available October 10-18, 2022

KEHP Vendor Contracts

| Benefit | Vendor | Phone Number | Website |

| Health Insurance Benefits | Anthem | 844-402-5347 | Anthem.com/KEHP |

| Prescription Benefits | CVS/Caremark | 866-601-6934 | Caremark.com |

| Well-being Information | Castlight

| 800-681-6758

| mycastlight.com/mybenefits |

| Shopper Discounts | Vitals SmartShopper | 855-869-2133 | SmartShopper.com |

| HRA Benefits | HealthEquity

| 877-430-5519 | HealthEquity.com |

| | Other Important Numbers and Websites | | |

| LiveHealthOnline | Online Medical Psychology and Psychiatry | 888-548-3432 | Anthem.com/KEHP |

| 24/7 Nurseline | 24/7 Nurseline | 877-636-3720 | |

| 24/7 Substance Use Disorder telephone resource line | Substance Use Disorder telephone resource line | 855-873-4931 | |

| Personal Health | Personal Health Consultants | 844-402-5347 | |

| Behavioral | | 800-714-9285 | Rethinkbenefits.com |

| Diabetes Prevention Program | | | lark.com/anthem |

| Deferred Comp | | 800-542-2667 | Kentuckyplans.com |

| | Retirement Systems' Phone Numbers

| | |

| LRP and JRP Retiree Questions | Judicial Retirement Plan and

Legislators' Retirement Plan | 502-564-5310 | |

| KCTCS Retiree Questions | Kentucky Community and Technical College System Retirement Plan

| 859-256-3100 | |

| KPPA Retiree Questions | Kentucky Public Pensions Authority

| 800-928-4646 502-696-8800 | kyret.ky.gov |

| TRS Retiree Questions | Teachers' Retirement System | 800-618-1687 502-848-8500 | trs.ky.gov |

KEHP Information

PY 2023 KEHP Legal Notice

PY 2023 KEHP Tobacco Use Declaration

PY 2023 KEHP Terms and Conditions

PY 2023 LivingWell CDHP Medical Benefit Booklet

PY 2023 LivingWell PPO Medical Benefit Booklet

PY 2023 LivingWell Basic CDHP Medical Benefit Booklet

PY 2023 Summary Plan Description LivingWell CDHP Prescription Drug Plan

PY 2023 Summary Plan Description LivingWell Basic CDHP Prescription Drug Plan

PY 2023 Summary Plan Description LivingWell PPO Prescription Drug Plan

PY 2023 KEHP Value Formulary Quick Reference List

PY 2023 CVS Caremark Advanced Control Specialty Formulary

PY 2023 PrudentRx Specialty Drug List