2026 Regular Session

Week 5 Highlights (February 2-6)

- Senate Bill 102 passed the Senate and now moves to the House for consideration. This bill would allow former Trooper R Class or commercial vehicle enforcement officer R class employees to return to work for the Kentucky State Police after one month, but within 60 months, of their latest separation from service date.

This week we added two bills to our watchlist. KPPA is now tracking 28 retirement-related bills:

The House and Senate will convene at 4 p.m. ET on Monday, February 9. Live coverage is available through KET Legislative Coverage and the LRC YouTube Channel.

Public Pension Oversight Board (PPOB) Meeting

The Public Pension Oversight Board will meet on Friday, February 13, in Capitol Annex Room 131 upon adjournment of both chambers. The agenda and meeting materials LRC website when available.

2026 Regular Session Overview

The 60-day session convened on Tuesday, January 6. View the full calendar here:

2026 Regular Session Calendar

Highlights include:

-

Budget Year: This session will include passage of the Commonwealth’s biennial state budget.

-

Filing Deadline for New Bills: March 2 (Senate) and March 4 (House)

-

Veto Period: April 2 to April 13

-

Adjournment Deadline: The session may not last more than 60 legislative days and cannot extend beyond April 15. A "legislative day" is defined as a calendar day, excluding Sundays, legal holidays, and any day on which neither chamber meets.

2025 Regular Session

Four retirement-related bills passed during the 2025 Regular Session: two affect specific members and two affect administrative processes. You can read our complete summary here .

Law changes affecting members are typically based on specific membership details, such as participation date, benefit tier, and hazardous or nonhazardous service credit. To see your retirement account summary, log in or register at MyRetirement.ky.gov.

Legislative Tracking

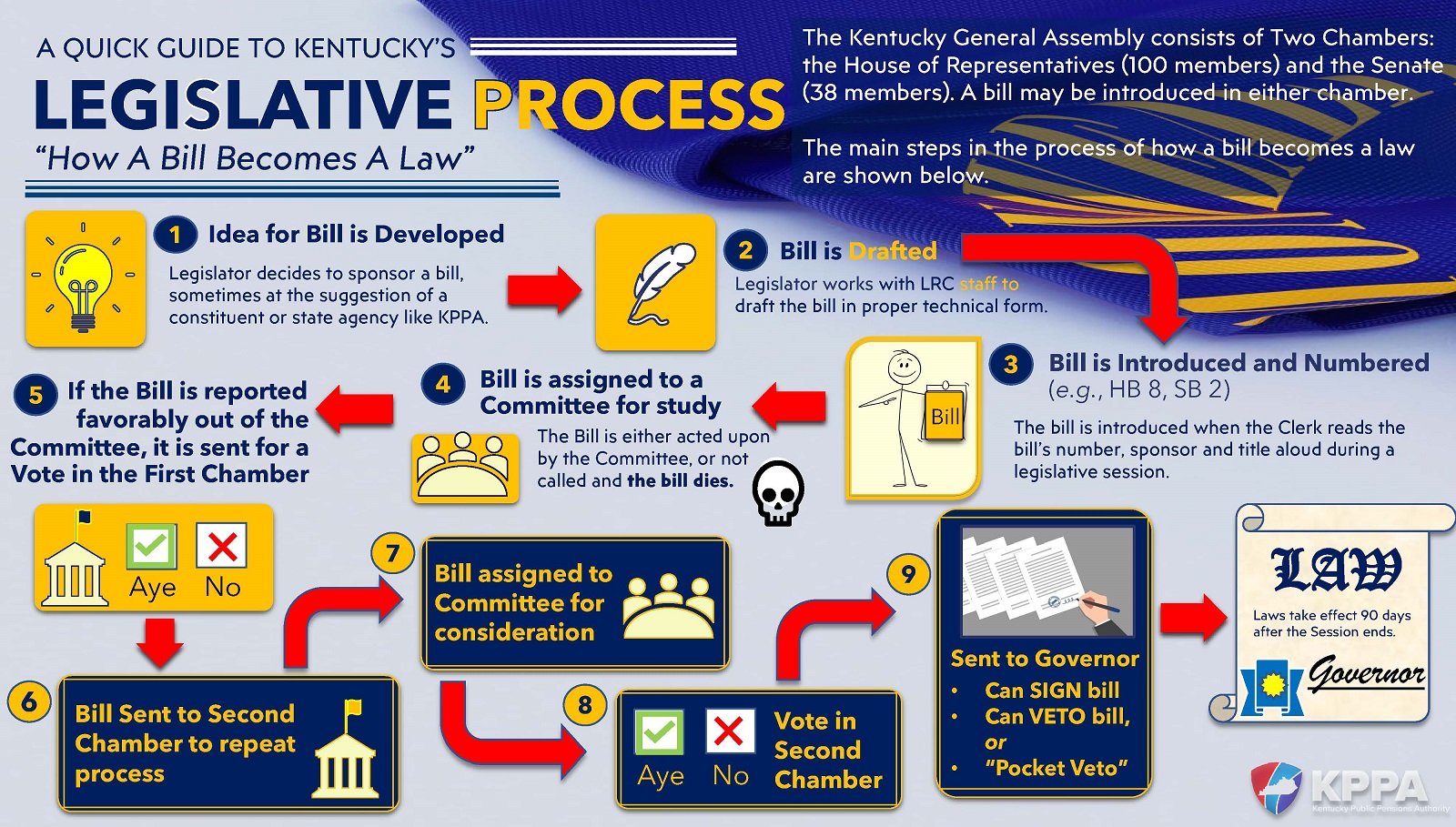

During legislative sessions, KPPA tracks proposed legislation of importance to the systems and their members as the legislation moves through the process.

We provide an overview of the most significant bills and resolutions passed this Session that will have an impact on the Kentucky Public Pensions Authority (KPPA).

If you're interested in the legislative process you can always watch committee meetings and the proceedings of both chambers

live on KET or on the Legislative Research Commission (LRC)'s

YouTube channel.

You can click below to see a graphic showing the legislative process in the Kentucky General Assembly.

These legislative summaries are intended for general informational purposes only and should not be relied upon as legal advice regarding the legislative meaning, purpose, intent, application or administration of a particular statutory change.

If you have questions or concerns regarding the impact of a particular piece of legislation, please contact the Legislative Research Commission or a qualified attorney. If you have questions regarding your Kentucky Public Pensions Authority benefits, please contact us by

email;or by telephone at (800) 928-4646.

Public Pension Oversight Board Materials

The Public Pension Oversight Board assists the General Assembly with its review, analysis, and oversight of the administration, benefits, investments, funding, laws and administrative regulations, and legislation pertaining to the Kentucky Public Pensions Authority.