What you Need to Know for 2025:

-

Your Cost for Coverage: Depending on your individual account, your cost may not increase. See below under

Contribution Amounts.

-

Hazardous Yearly Requirement: Hazardous members with insurance dependents have to complete a

Form 6256 every year. Form 6256 can be submitted with your online enrollment, uploaded using the Documents feature in

Self Service, or can be faxed or mailed to KPPA.

-

LivingWell Promise Required: All plan holders who are 18 or older must fulfill the LivingWell Promise between January 1, 2025 - July 1, 2025 to earn premium discounts in 2026. Go to mycastlight.com/mybenefits to complete the online Health Assessment.

-

Cross reference: You may be eligible to cross reference if:

- You are a new retiree who was enrolled in KEHP coverage prior to January 1, 2025, and your spouse is currently enrolled in a KEHP plan.

- You were enrolled in a KEHP plan prior to January 1, 2025, and experience a qualifying event. For additional information, contact KPPA and speak to a Retiree Health Plan Counselor about your individual benefit.

- If you have the cross reference option:

- You and your spouse must both fulfill the LivingWell Promise;

- If you both fulfill the Promise, you and your spouse will not be responsible for paying an additional $40 LivingWell fee every month in 2026;

- If only one of you fulfills the Promise, then the other person will be responsible for paying an additional $40 LivingWell fee every month in 2026.

-

What if me or my spouse is becoming Medicare Eligible (Turning Age 65) in 2025?: KPPA will notify you about 6 weeks prior to the date of your Medicare eligibility. Detailed instructions on how to make this transition will be included with this mailing from KPPA or you may also view this short video on how this process works: KPPA and the Transition to Medicare

-

Medicare Secondary Payer Act: In certain circumstances, a Medicare-eligible retiree's reemployment with a participating agency will prevent KPPA from offering enrollment in a KPPA Medicare Advantage Plan. Read more

here.

Please refer to our New Retiree Insurance Book for additional information.

Plan Information

- No dental or vision coverage is available for Non-Medicare eligible retirees through Anthem; however, you can see optional coverage by visiting the Dental and Vision section of our Books and Guides page.

- Retired members eligible for dollar contribution who do not elect coverage through KPPA may be eligible to have premiums reimbursed for insurance coverage under a non-KPPA plan. To learn more about this

reimbursement program,

read our FAQs.

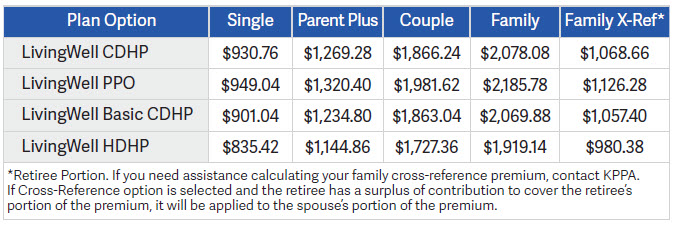

2025 Premiums

Plan Options

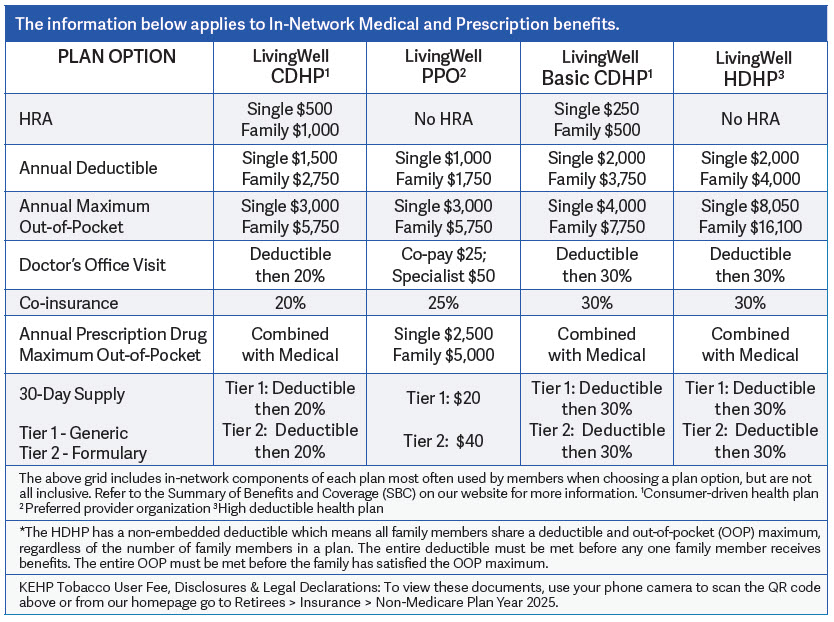

Benefits Grid

Contribution Amounts

To determine your cost for coverage, please refer to the worksheets below.

KPPA pays a percentage of the monthly contribution rate or a dollar amount toward insurance coverage for eligible retirees and beneficiaries. Any portion paid toward

eligible spouse and dependent coverage is based on the member’s hazardous service credit.

A percentage contribution is paid for members participating prior to July 1, 2003.

Hazardous Percentage Contribution Premium Calculation Worksheet

Use this worksheet if you meet all of the following:

- You have hazardous service or combined hazardous and nonhazardous service.

- You are a retiree or a beneficiary receiving benefits.

- Your participation date with KPPA was prior to July 1, 2003.

Nonhazardous Percentage Contribution Premium Calculation Worksheet

Use this worksheet if you meet all of the following:

- You have nonhazardous service.

- You are a retiree or a beneficiary* receiving benefits.

- Your participation date with KPPA was prior to July 1, 2003.

A dollar amount is paid for members participating July 1, 2003 and after, and the retired member must meet service requirements to be eligible for insurance benefits.

Dollar Contribution Premium Calculation Worksheet

Use this worksheet if you meet all of the following:

- You have hazardous and nonhazardous service.

- You are a retiree or a beneficiary* receiving benefits.

- Your participation date with KPPA is between July 1, 2003 and August 31, 2008. You must have a minimum of 120 months of service to be eligible for insurance benefits, OR

- Your participation date with KPPA is on or after September 1, 2008. You must have a minimum of 180 months of service to be eligible for insurance benefits.

- If you have hazardous and nonhazardous service, you will receive contribution based on full years of service for each. If you have partial years of service, please contact KPPA.

*KPPA does not pay a contribution for coverage on behalf of a beneficiary. Exception: If you are a spouse beneficiary or a dependent child receiving a monthly benefit under the Fred Capps Memorial Act, contact KPPA.

Current Dollar Contribution

| Nonhazardous

| Hazardous

|

Monthly Contribution

| $14.85

$10 per month for each year

of service*

| $22.27

$15 per month for each year

of service*

|

*The dollar contribution increases on July 1 by 1.5%.

Dollar Contribution Formula:

Dollar Contribution Amount x Years of Service = Amount KPPA pays each month.

Hazardous Example:

If you began participating September 1, 2003 in a hazardous position and retired effective October 1, 2013, you would receive $222.70 per month towards health insurance premiums.

$22.27 x 10 years of service = $222.70

Nonhazardous Example:

If you began participating September 1, 2003 in a nonhazardous position and retired effective October 1, 2013, you would receive $148.50 per month towards health insurance premiums.

$14.85 x 10 years of service = $148.50

If you have hazardous and nonhazardous service, you will receive a contribution based on the number of full years of service for each.

For example, if you participated in a nonhazardous position from September 1, 2003 to September 30, 2008, KPPA would pay $74.25 toward your coverage ($14.85 x 5 years of service = $74.25). If you also participated in a hazardous position from October 1, 2008 to October 1, 2013, KPPA would pay an additional $111.35 toward your coverage ($22.27 x 5 years of service = $111.35).

In this example KPPA would pay a total of $185.60 per month towards your health insurance coverage

($74.25 + $111.35 = $185.60).

If you have a partial year of hazardous service and a partial year of nonhazardous service, they can be combined to equal a full year of nonhazardous service credit for contribution purposes.

For example if you have 9 years and 6 months of nonhazardous service and 6 months of hazardous service, your insurance contribution will be based on 10 years of nonhazardous service. You will receive $148.50 per month towards health insurance premiums.

If you need assistance determining your cost for coverage, please contact KPPA at 1-800-928-4646.

TOBACCO USER NOTICE****

The Commonwealth of Kentucky is committed to fostering and promoting wellness and health in the workforce. You are eligible for the non-tobacco user premium contribution rates provided you certify that you and any other person to be covered under your plan has not regularly used tobacco within the past six months.

Regularly means tobacco has been used four or more times per week on average excluding religious or ceremonial use.

Tobacco means all tobacco products including, but not limited to, cigarettes, pipes, chewing tobacco, snuff, dip, and any other tobacco products regardless of the frequency or method of use.

Dependent means, for the purpose of the Tobacco Use Declaration, only those dependents who are 18 years of age or older. If you have regularly used tobacco within the past six months, you are subject to the monthly fee . For those with single coverage, the fee is $40.00 per month. For those with any dependent coverage (Parent Plus, Couple, Family), even if only one person uses tobacco, the fee is $80.00.

Additional Resources

KEHP Prescription Drug Coverage

KEHP Value Benefits for Diabetes, COPD, and Asthma

KEHP Diabetes Benefits

KEHP Vendor Partners

Diabetes Prevention

LiveHealth Online

SmartShopper

KEHP Legal Notices

KEHP Vendor Contracts

| Benefit | Vendor | Phone Number | Website |

| Health Insurance Benefits | Anthem | 844-402-5347 | Anthem.com/KEHP |

| Prescription Benefits | CVS/Caremark | 866-601-6934 | Caremark.com |

| Well-being Information | Castlight

| 800-681-6758

| mycastlight.com/mybenefits |

| Shopper Discounts | Vitals SmartShopper | 855-869-2133 | SmartShopper.com |

| HRA Benefits | HealthEquity

| 877-430-5519 | HealthEquity.com |

| | Other Important Numbers and Websites | | |

| LiveHealthOnline | Online Medical Psychology and Psychiatry | 888-548-3432 | Anthem.com/KEHP |

| 24/7 Nurseline | 24/7 Nurseline | 877-636-3720 | |

| 24/7 Substance Use Disorder telephone resource line | Substance Use Disorder telephone resource line | 855-873-4931 | |

| Personal Health | Personal Health Consultants | 844-402-5347 | |

| Behavioral | | 800-714-9285 | Rethinkbenefits.com |

| Diabetes Prevention Program | | | lark.com/anthem |

| Deferred Comp | | 800-542-2667 | Kentuckyplans.com |

| | Retirement Systems' Phone Numbers

| | |

| LRP and JRP Retiree Questions | Judicial Retirement Plan and

Legislators' Retirement Plan | 502-564-5310 | |

| KCTCS Retiree Questions | Kentucky Community and Technical College System Retirement Plan

| 859-256-3100 | |

| KPPA Retiree Questions | Kentucky Public Pensions Authority

| 800-928-4646 502-696-8800 | kyret.ky.gov |

| TRS Retiree Questions | Teachers' Retirement System | 800-618-1687 502-848-8500 | trs.ky.gov |